J Singleton Financial, an independent wealth management firm offering securities through Raymond James Financial Services, Inc., is pleased to announce the appointment of Hadyn Peery, CFP® as partner, effective July 1, 2020.

Tag Archive for: Raymond James

January 9, 2020

At Raymond James, we recognize the trust you place in us when you disclose personal information. Maintaining that trust by ensuring that your information is secure is core to our business. Raymond James has a dedicated Privacy Office committed to the privacy and protection of your personal information entrusted to us.

From technological safeguards to employee policies and operating procedures, we maintain constant vigilance where your privacy is concerned.

We at J SINGLETON FINANCIAL focus the majority of our time on giving thoughtful financial advice to our clients. However, from time to time we find ourselves sourcing additional ways that we can have an impact in our community. We do not claim to be musical geniuses, but this past week our office got […]

January 10, 2019

J Singleton Financial would like to share with you an interview Judy had the pleasure of doing with Stephan Abrams for The Jackson Hole Connection, a podcast created and inspired by the many stories of the wildly interesting folks connected to Jackson Hole.

Below is a brief description of Judy’s interview with Stephan.

“In this week’s episode of the Jackson Hole Connection, Stephan visits Judy Singleton. Judy is a entrepreneur, financial planner, world traveler, and a former Yellowstone Parkie. Judy started visiting Jackson Hole on family road trips in the 50s. At the advice of her sister, Judy’s first solo experience out in Wyoming was working a summer in Yellowstone at the Snow Lodge in 1971. In 1984 after opening a successful candy and nut shop in Alabama, Judy decided to take her business up to Teton Village.

Stephan and Judy talk about ambition, hitch hiking, being a Parkie, opening a business, traveling by train, surviving in Jackson Hole, learning new skills, and what motivated Judy to become a financial planner.”

RAYMOND JAMES

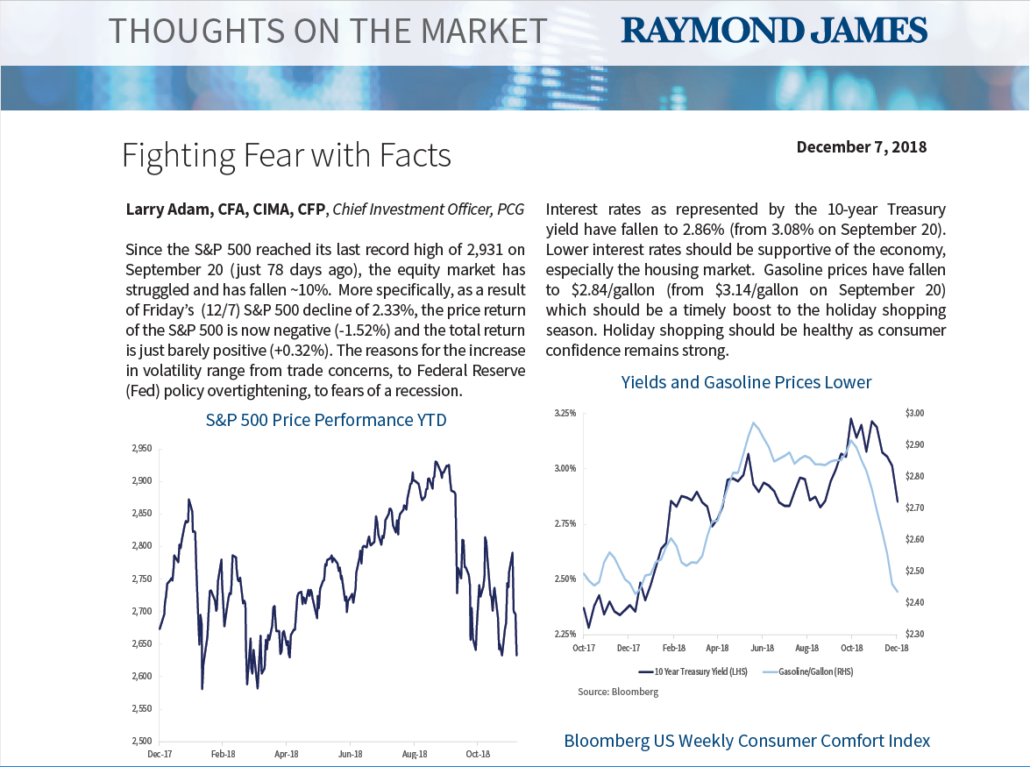

Fighting Fear with Facts

Larry Adam, CFA, CIMA, CFP, Chief Investment Officer, PCG

Why have the markets been so volatile lately? Chief Investment Officer Larry Adam shares his thoughts about the recent market activity.

December 10, 2018

Good afternoon,

Times of market volatility often bring feelings of apprehension and uncertainty which makes it all the more important to take stock of the underlying market data. The below piece from our Chief Investment Officer Larry Adam does just that.

Thank you,

Judy & Hadyn

A Monthly Chart Presentation and Discussion Pulling Together the Disciplines of Economics, Fundamentals, Technical Analysis, and Quantitative Analysis Published by Raymond James & Associates

June 7, 2018

This last month Hadyn and I attended Raymond James’ national conference in Washington D.C. Time was spent visiting historic sites (The White House & Mount Vernon), professional development, and meeting with some of the best and brightest the financial industry has to offer. A few highlighted speakers that we heard from were Andy Friedman, commonly referred to as “one of the nation’s most sought-after speakers on all things political”, Robert Gates, former US Secretary of Defense, and Adam Alter, who spoke about our society’s current addiction to screens.

We also attended two intimate dinners – one with Jeff Saut, Raymond James’ Chief Investment strategist, and one with James Camp Co-portfolio manager of Eagle Strategic Income. Both dinners were very productive.

The conversation at dinner with James Camp centered on the discipline that it takes to stick to an investment strategy when it is out of favor with what is currently popular. In a day and age where everyone seems to have the secret to the next investment home run it was good to hear some level headed thoughts about keeping it simple and investing in high quality – so called “boring” investments.

Our night out with Jeff Saut was a real treat. We went to dinner a top the W Hotel adjacent the White House. Being able to discuss the markets one on one with Jeff was amazing. He reiterated why he thinks the markets are headed higher and we are in a secular bull market – “The economy is stronger than a garlic milkshake!”.

All in all it was a very productive trip. Every now and then it is good to step away from day to day obligations and spend time focusing on how we can better serve our clients. We cannot wait to take the insights we learned and improve our deliverables to our clients.

Sincerely,

Judy

Any opinions are those of Judy Singleton and not necessarily of Raymond James.

About Us

At Singleton Peery Financial, located in Jackson, Wyoming, our team provides our clients the information they may need to choose the most suitable investment products and services for their specific financial needs, including asset management, retirement plans, trust services, managed accounts, 401(k) plans, life insurance and more.

Singleton Peery Financial

170 E Broadway Suite 100D

P.O. Box 508

Jackson, WY 83001

T: 307.732.6652

F: 307.732.6658

Our Office Hours

Monday-Friday 7am-4pm

Saturday-Sunday Closed